FAQ

How do I sign up for online banking?

To sign up for online banking, Select ‘Personal’ for Online Banking Login at the top of the Home screen. Click ‘Enroll Now’ at the top left of the page. Follow the steps to create a username, password and security questions.

What do I need to have with me to open up an account with PSB?

Please bring a government issued photo ID. We will need a copy of a social security for a minor, any individual that lacks a credit background or possibly an individual that has had to change their name.

Businesses will need to bring the government issued photo ID for all beneficial owners and signers on the account and provide the EIN document from the IRS. Depending on the type of business we may need: partnership agreement, Secretary of State Registration, Articles of Incorporation or a trade name filing for sole-proprietors.

Estates, Trusts and Clubs/Organizations will need to bring the government issued photo ID for all signers/trustees/grantors on the account and provide the EIN document from the IRS if applicable. Estates will need to provide the Letter of Testamentary or Letter of Administration. Trusts will need to provide a copy of the trust agreement (at least the appointment and signature pages). Clubs will need to provide meeting minutes expressing the club’s wishes for the account.

Where can I find my account and routing number?

The bank routing number is 073920531. Your account number can be found at the bottom of your checks. With the PSB Mobile Connect app, select the account you want and click on the eyeball to make the number visible. If you still need help, please call the bank at (877) 508-2265 and we can provide you with your account number after secure verification over the phone.

How do I stop payment on a check or ACH (automatic withdraw or deposit)?

To stop payment on a check or ACH, please call the bank at (877) 508-2265. You will have to provide the date of the check or ACH, who the check was written to or who the ACH was received from, the dollar amount, the check number, as well as coming by the bank to sign a stop payment form or providing an email address to sign the form electronically from anywhere.

You can place a stop pay on a check through your online banking account. Log in to your account through our website and click on the account containing the check. Click on the icon for Stop Payments above the account information in the middle of the screen and fill in the required information.

How do I order checks?

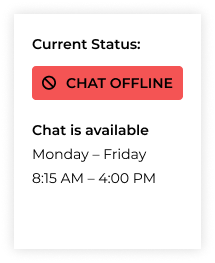

You can order checks online – you’ll need the banks routing number (073920531) and your account number. You can also message us through live chat, stop in or give us a call.

How do I activate my new debit card?

Call (800) 992-3808 and follow the prompts.

What if I can’t get my debit card activated?

Please be sure you are calling to activate your card from the phone number we would have on file for you to be sure that is not the issue. I you are able to activate the card but unable to set up a PIN, this is likely the issue.

If you are calling from your phone line and it is still not working, call the bank at (877) 508-2265 and anyone that answers can review the issue with the card processor and fix the issue so you can set up a PIN by calling (800) 992-3808.

How can I report my debit card as lost or stolen?

- If you use our app, PSB Mobile Connect, select “Cards” at the bottom of your screen, choose the card you wish to deactivate and move the “On” button to “Off.”

- Call PSB at (641) 869-3721 during business hours or dial (800) 383-8000 outside of business hours for 24/7 service to report a lost or stolen card.

- Always call PSB at (641) 869-3721 to cancel the card and have a new card ordered.

My debit card is expiring, when will I receive a new one?

Debit cards are mailed the third week of the expiration month listed on your card. For example if your card expires in the month of July, you will receive a replacement card in the third week of July. Your card is valid for the entire month.

How can I make a mobile deposit?

From your smartphone, log onto our PSB Mobile Connect app. At the bottom, click ‘deposit,’ choose ‘deposit a check,’ select the account the deposit is to go into, type in the check amount, then select ‘Take photos.’ At this point, you should sign the back of the check, write ‘for mobile deposit at PSB’ on the back, take a picture of your check front and back on a solid background, and click submit.

What does it mean when a transaction is pending?

A pending transaction is when the merchant accepts your payment, but the transaction has not been fully processed on your account yet. The transaction usually hits the account within 1-2 business days.

Some businesses (commonly gas stations) will place a pending hold on funds up to $150.00 until they process the transaction completely.

If there is a stop pay on your account, a pending transaction could go away for a day to be processed as a possible stop pay item and then come back the following day to process since the item did not need to be stopped.

What is an ACH?

ACH stands for Automated Clearing House. It is a networking system that makes transfers easier, quicker and more convenient. ACH transfers are a more efficient and reliable form of receiving or making payments. Examples of ACH transactions: payroll transfers such as direct deposit of paychecks, social security benefit payments, utility bills, and credit card payments.

What are some red flags for scams?

Some red flags to look out for regarding finances are getting a check you don’t know about in the mail for a large amount, letters asking you to cash a check and send money back, a seemingly official or credible person asking for personal information over the phone, anyone asking for your online banking username and password, letters saying you’ve won money and steps you should do to claim the funds.

No reputable business or organization you deal with will ever ask for private personal or financial information over the phone or via email. If this occurs, hang up the phone immediately and contact the business/organization with the contact information you already possess. If you are ever unsure; call the bank and we will work through the situation with you.

What if I can’t get into my online banking?

You can try to click on “FORGOT PASSWORD” if you believe that is the problem, otherwise call the bank at 877-508-2265 and anyone that answers can review your online account and get you back up and running.

What are the current IRA contribution limits?

For current IRA contribution limits, visit the IRS website.

Contact Us

Information sent via email is not secure and subject to intercept. Non-public personal information should not be transmitted through this contact form!